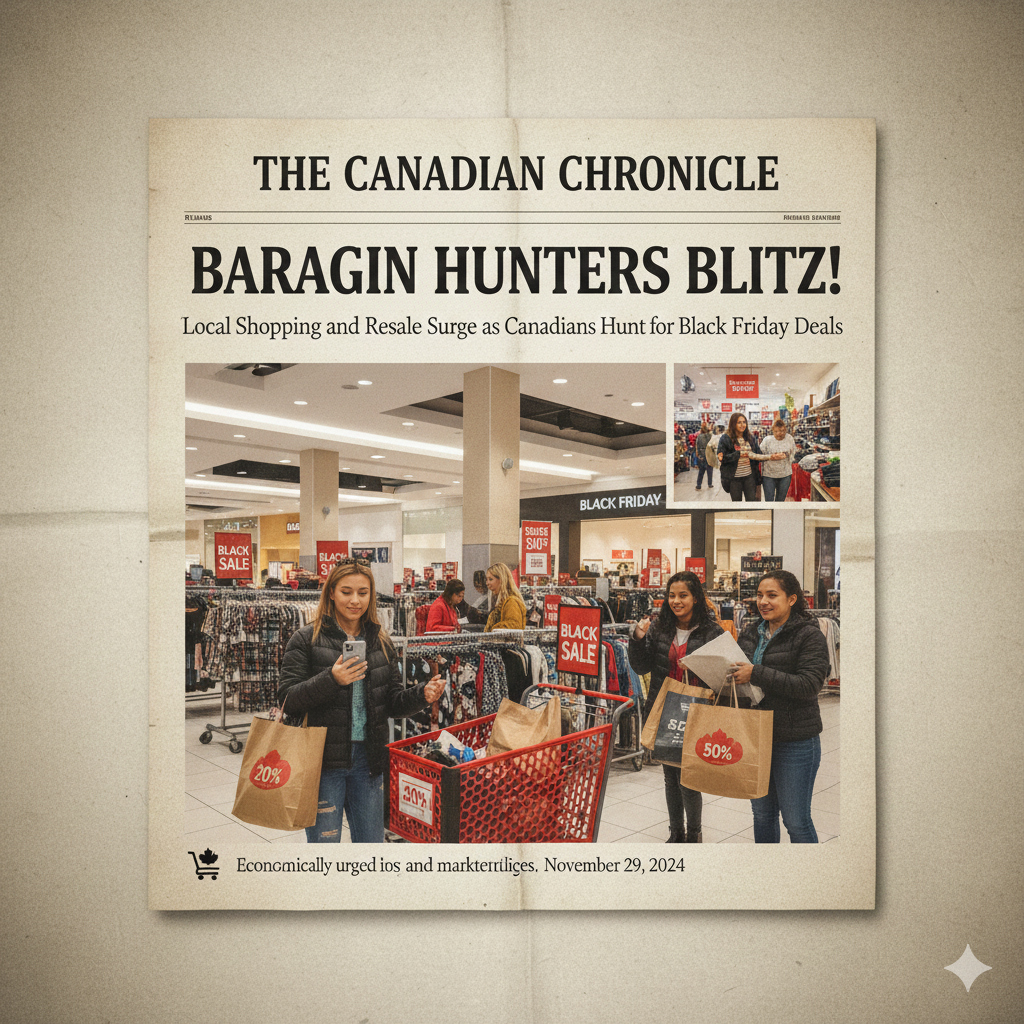

Malls and main streets across Canada were packed with shoppers this week as Black Friday promotions reached their peak, highlighting how Canadians are adapting their shopping habits in response to economic pressure, tariff concerns, and the rising cost of living.

Once a single, high-energy day of blockbuster deals, Black Friday has evolved into a month-long cycle of rolling discounts that now begins weeks before the day itself. This year, Canadian consumers are responding not only to deep price cuts but also to shifting priorities — looking closer to home for value and exploring resale as an alternative way to stretch their dollars.

According to a new survey from BMO, financial caution is shaping holiday spending decisions in 2025. While most Canadians plan to spend a similar amount as last year, the way they shop — and where they choose to spend — is changing dramatically.

Rising Costs Push Canadians to Rethink Holiday Spending

Inflation, tariff concerns, and ongoing economic uncertainty continue to influence how much Canadians are willing and able to spend on holiday shopping.

The BMO survey revealed that three in five Canadians plan to adjust their holiday spending this year due to growing financial pressure. Nearly half of respondents admitted that the lure of seasonal discounts often leads them to spend more, or buy more gifts, than they originally intended.

Retail analyst Bruce Winder explained that while many shoppers expect to spend around the same amount as 2024, the challenge lies in the increased price of goods.

“Most shoppers today are going to be spending, or anticipate spending, at least what they spent last year,” he said in an interview with CTV News Channel. “But the challenge is that things are decidedly more expensive this year, so shoppers are really on the hunt for bargains.”

This search for value has created a more strategic consumer — one that compares prices carefully, waits for deeper discounts, and refuses to pay full retail unless necessary.

Black Friday: No Longer a Day, But a Month-Long Retail Season

What was once a high-stakes, 24-hour shopping event has now turned into an extended retail marathon.

Experts say the holiday shopping season effectively begins shortly after Halloween — and in some cases even earlier. Retailers start rolling out promotions weeks ahead of Black Friday, leading to a phenomenon analysts now describe as “discount fatigue.”

Winder referred to this as a “pervasive creep” in the industry, where markdowns appear earlier every year.

Holiday deals now stretch from early November through Cyber Monday and beyond, blurring the traditional boundaries of the shopping calendar.

With the rise of online shopping events such as Amazon Prime Day, mid-season flash sales, and pre-holiday promotions, some Canadians have already completed a significant portion of their gift buying long before Black Friday arrives.

“Some holiday spending may have happened months ago,” Winder explained.

As a result, Black Friday is no longer the only focal point — but it still remains a powerful driver of foot traffic and online activity.

Businesses Lean Into Personalized Marketing

To capture the attention of increasingly cautious shoppers, retailers are relying heavily on targeted and personalized marketing strategies.

Retail analyst Liza Amlani said brands are doubling down on direct communication with customers through email offers, app notifications, loyalty programs, and personalized product recommendations.

“I’m seeing retailer brands lean into personalized marketing to lure customers, either onto websites or into stores,” Amlani said.

These strategies are especially effective as consumers grow more selective about how they spend. Rather than responding to mass advertisements, shoppers now expect tailored offers that reflect their preferences and buying history.

Loyalty perks, exclusive discounts, and location-based promotions have become valuable tools in attracting customers during the ultra-competitive holiday season.

Shift Away From U.S. Retailers Toward Local Canadian Businesses

Perhaps the most notable trend this year is the rise in support for local and Canadian-owned businesses.

Both analysts observed a measurable shift in shopping behavior, with many Canadians intentionally choosing to avoid large American chains in favor of homegrown brands, small businesses, and local specialty shops.

“They are basically avoiding large American retailers, both online and offline, in favour of trying to do things locally,” Winder said.

Amlani agreed, calling the trend encouraging for Canada’s retail economy.

“We’re going to see a little bit more activity in local shopping, local in specialty stores, which is a great thing to see, because we want to see people shopping our own Canadian brands,” she said.

This movement is being supported by grassroots campaigns encouraging shoppers to “Buy Canadian” and invest in their own communities, particularly as concerns rise over tariffs, foreign supply chains, and economic independence.

For local businesses, the change is significant. Increased foot traffic and sales during Black Friday and the holiday season can provide critical financial relief after several challenging years marked by pandemic closures and tight consumer spending.

Resale and Second-Hand Markets Gain Ground

Another rapidly growing trend is the rise of resale and second-hand shopping as a mainstream option.

Canadians are turning to thrift stores, online resale platforms, and vintage retailers as a way to reduce costs without sacrificing quality or style.

Winder says resale offers not only financial savings, but environmental benefits.

“Many shoppers see it as a way to save money and at the same time save a lot of things from going to a landfill site,” he explained.

The resale market is no longer viewed as a last resort; in fact, it has become fashionable and socially conscious, especially among younger shoppers. Clothing, electronics, furniture, and even luxury goods are increasingly purchased second-hand.

This aligns with a growing demand for sustainability, where consumers actively seek to reduce waste and lower their environmental footprint — even during the most commercially intense season of the year.

The Risk of Permanent Discount Culture

While shoppers benefit from year-round markdowns, analysts warn that constant discounting could create long-term problems for retailers.

Amlani cautions that an overreliance on sales may “train customers” to wait for low prices, reducing willingness to pay full value for products.

When promotions become permanent, the perceived value of goods decreases, potentially eroding brand equity and profitability. Retailers then face pressure to maintain deeper and more frequent discounts just to stay competitive.

This “race to the bottom” is risky, especially for smaller and independent businesses that may not have the same profit margins as major corporate chains.

For sustainable growth, experts suggest that retailers must balance value pricing with quality, experience, and service — offering more than just lower tag numbers.

A New Era of Smart, Conscious Shopping

Black Friday 2025 showcases a Canadian consumer who is more price-aware, community-oriented, and environmentally conscious than ever before.

Instead of impulsive spending, many shoppers are:

-

Comparing prices across multiple platforms

-

Supporting local businesses

-

Buying second-hand or refurbished items

-

Choosing experience and value over brand names

-

Limiting wasteful purchases

While malls remain crowded and online checkouts busy, the deeper story is not just about discounts — it’s about transformation.

Canadians are redefining Black Friday. It is no longer simply a race for the biggest deal, but an opportunity to spend more intentionally, support local economies, and make smarter financial decisions in uncertain times.

As holiday shopping continues into December, retailers and consumers alike will be watching closely to see whether this shift becomes a lasting cultural change — or simply a response to another tough economic year.

Leave a Reply